Payroll Savings explained: what it is, how it works, and why it matters

If you’ve ever wondered what a Payroll Savings scheme is, you’re not alone. Conversations about Payroll Savings are on the rise, and for good reason: with financial stress affecting millions across the UK, more employers and employees are turning to Payroll Savings as a simple, effective way to build long-term financial resilience.

In this post, we explain what Payroll Savings actually means, how it works, and how to choose the best approach for your team or yourself.

What is a Payroll Savings scheme?

A Payroll Savings scheme (occasionally referred to as a Payroll Savings plan) is simply the term for any formal programme run by an employer that helps staff save money directly from their wages. These schemes are often offered in partnership with third-party providers, like us at Sync!

The key benefits of a Payroll Savings scheme includes:

Automatic deductions: no friction or “decision fatigue”

Encourages consistent saving habits

Empowers employees to prepare for emergencies or short-term goals

Boosts overall wellbeing and productivity in the workplace

How does Payroll Savings work?

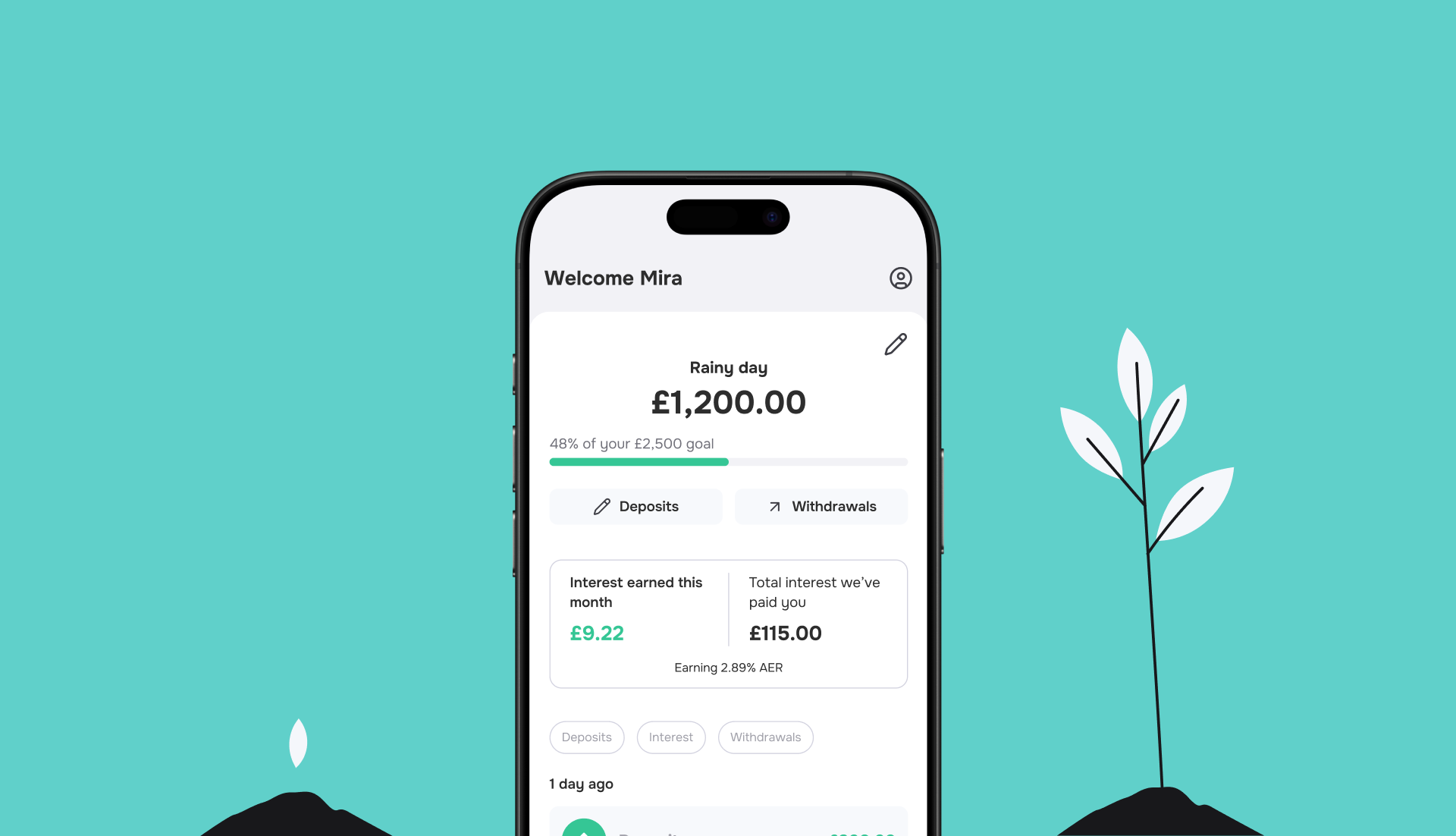

Payroll Savings is a workplace scheme that allows employees to set aside money directly from their salary into a separate savings account.

Here’s how it works:

Employees choose how much to save (e.g., £20 per pay cycle)

That amount is deducted automatically from their wages, before it hits their bank account

The money is transferred into a separate Payroll Savings account, where it grows over time 🌱

ℹ️ Payroll savings are taken from your net pay - that’s after tax and National Insurance. The money goes into a separate FSCS-protected savings account, where it’s yours to access whenever you need it (and therefore has no impact on national minimum wage calculations for employers).

Employees can view, track, and withdraw savings via a secure dashboard, with most withdrawals processed in one working day.

“This “set it and forget it” approach makes saving effortless and helps people build a healthy financial buffer without even thinking about it.”

Payroll Savings vs a standard savings account: what’s the difference?

A common question is how Payroll Savings differ from regular savings accounts.

Here’s the breakdown:

Payroll-linked savings are designed to make the process effortless - low-touch account opening, no new apps and no manual transfers to remember - just set it up once, and the money moves automatically each payday. Simple!

How much could I earn?

Ever wondered how much you could save just by putting aside a small amount from each paycheque? Find our using our free payroll savings calculator in seconds.

Just enter how much you’d like to save per month and how long for, and we’ll show you how quickly it can add up. You might be surprised by the numbers:

Saving £25/month = £300 + £5.18 in interest / year*

Over 5 years, that’s £1,500 + £129 in interest* - enough for a holiday, emergency fund, or peace of mind when life throws a curveball

👉 Sign up for Payroll Savings and start building a savings habit that sticks.

*subject to interest rates, which can fluctuate.

Why does this matter for employers?

If you're in HR, payroll or benefits, adding a Payroll Savings scheme is one of the simplest ways to make a real difference to your team's financial wellbeing.

Payroll Savings can:

Reduce financial stress and absenteeism

Improve productivity and morale

Help your team feel more secure and supported

Strengthen retention, especially in roles with high turnover

“It’s one of the easiest, most cost-effective ways to support financial wellbeing at work. In fact, 89% of employees say they want their employer to offer a Payroll Savings option.”

Final thoughts

Whether you're an employer looking to improve your benefits offer, or an employee looking to build better money habits, Payroll Savings is a simple but powerful tool.

It’s automatic.

It’s stress-free.

And it’s already helping thousands of employees save more without even thinking about it!

Ready to explore what Payroll Savings could look like in your organisation?

👉 Book a quick call with Sync - we’ll show you how easy it is to get started.

See you next payslip,

The Sync Team