The Sync blog

Insights, tips, and stories to help building financial resilience, simplify saving, and make financial wellness accessible to all.

Gen Z & Millennials: saving, spending, and what’s next

Gen Z and Millennials are saving more than ever, but still face financial risks. Discover their spending habits, optimism vs. worries, and how payroll savings can boost resilience for employees and ROI for businesses.

Breaking the taboo: talking about money at work

Talking about money isn't just about pay transparency; it's about connection, trust, and creating an environment where people feel safe enough to share their experiences and challenges.

From perk to priority: why Payroll Savings is the one feature every benefits platform needs in 2025

With financial stress now one of the biggest drivers of disengagement, absenteeism, and turnover, financial wellbeing has shifted from buzzword to boardroom priority. And when it comes to benefits platforms, one feature is moving rapidly from “nice to have” to non-negotiable: payroll savings.

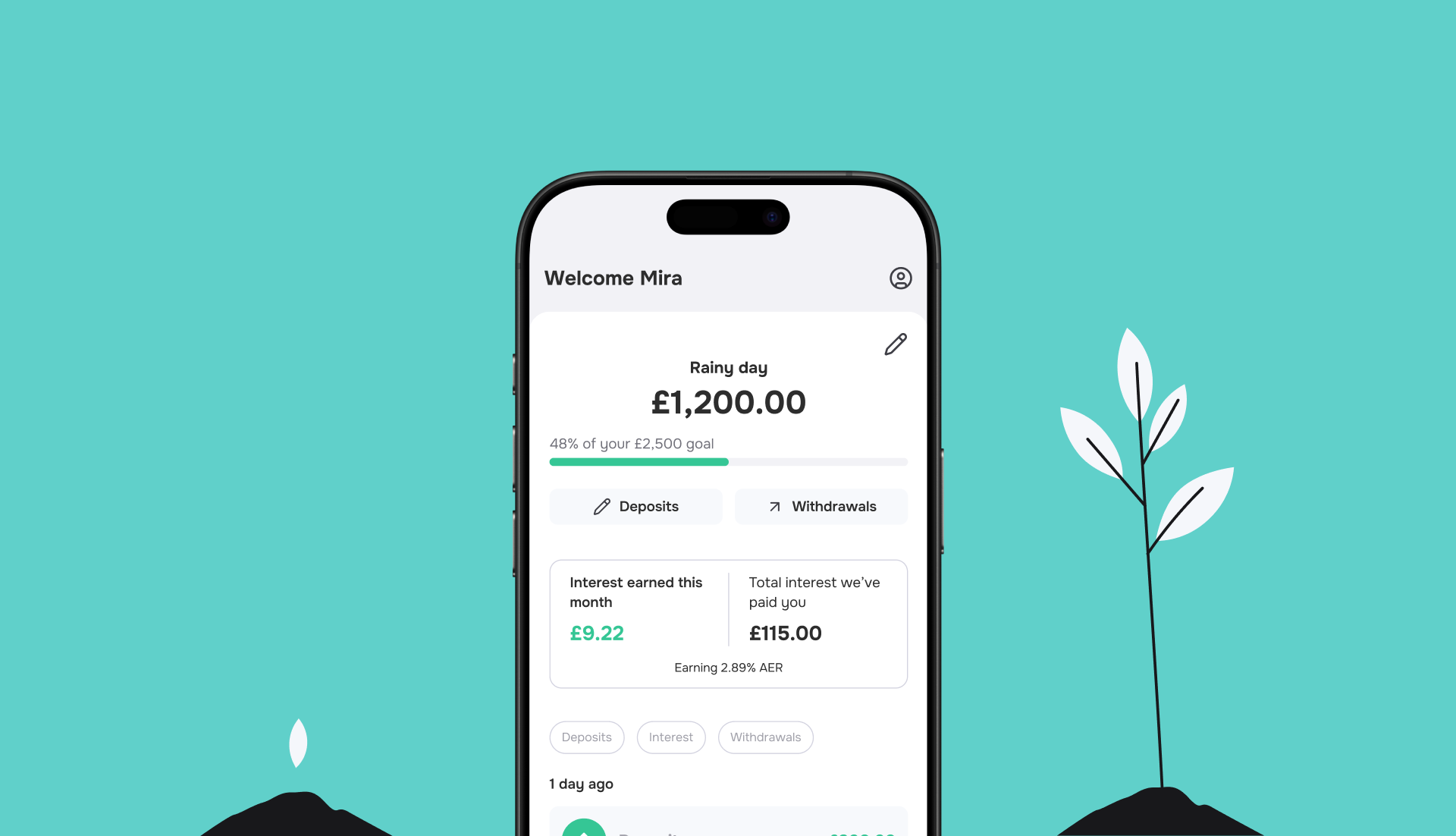

Payroll Savings explained: what it is, how it works, and why it matters

If you’ve ever wondered what a Payroll Savings scheme is, you’re not alone. Conversations about Payroll Savings are on the rise, and for good reason: with financial stress affecting millions across the UK, more employers and employees are turning to Payroll Savings as a simple, effective way to build long-term financial resilience.

In this post, we explain what Payroll Savings actually means, how it works, and how to choose the best approach for your team or yourself.

Sync x Money First Aid: A new chapter in financial wellbeing

At Sync, our mission has always been clear: to help people build financial resilience. And we’re doing that through smart, automated payroll savings. Today, we're excited to announce a partnership that that perfectly aligns with our mission.

We're teaming up with Money First Aid, a leading provider of financial wellbeing training, empowering individuals with the knowledge and tools to navigate financial challenges confidently.

The Nest Insight report, decoded: what it means for benefits, payroll and financial wellbeing

Everyone in payroll, HR and employee benefits is talking about it - and for good reason. Nest Insight’s Easier to Save report (off the back of a trial involving >70,000 employees) is the most detailed, data-backed look at how payroll-linked savings schemes could work at scale in the UK.

But if you haven’t had time to read all 90+ pages, don’t worry - we have.

And we’ve pulled out the five key takeaways that matter most if you're shaping a benefits strategy in 2025.

Cut costs, simplify admin and improve ROI - the smarter way to deliver payroll-linked benefits

In 2025, the pressure on payroll and benefits teams is real. Inflation, retention risks, tighter budgets, legacy systems… It’s no wonder HR and payroll professionals are rethinking how to deliver meaningful benefits with less complexity and more measurable value.

But there’s good news: the answer doesn’t always lie in costly new platforms or perks. Sometimes, the simplest tools can drive the biggest impact. Enter payroll savings.