The only UK Payroll Savings provider with 100% employee eligibility

Saving through payroll made easy, automatic, and immediately available to every single employee.

With Universal Access Payroll Savings, employers get:

✅ Instant eligibility for the whole workforce

✅ Zero onboarding barriers or approval flows

✅ A benefit built for total inclusion

Want this benefit as an employee? Email your HR team

The gap we’re fixing

Workplace pensions made long-term saving automatic. Short-term saving never got the same treatment. As a result, financial pressures are rising in the UK.

14m

of UK adults have

no emergency buffer

1 in 3

of UK adults has less than £1,000 saved

49%

of UK adults are

financially vulnerable

Introducing Universal Access Payroll Savings

Universal Access makes every employee instantly eligible for a regulated savings account via payroll. And enrolling takes just seconds.

01

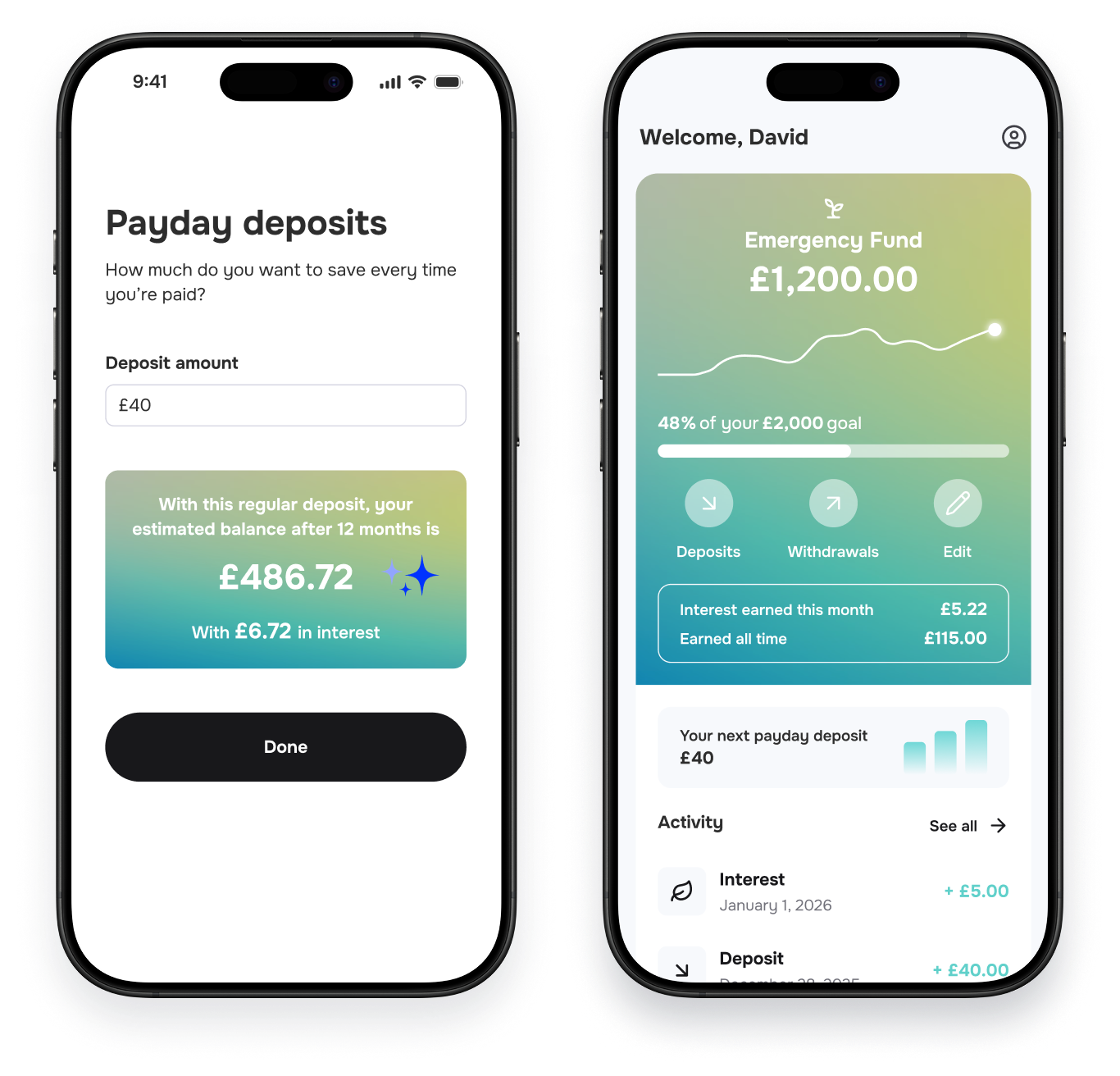

Employees choose how much to auto-save each payday in their high-interest, FSCS-protected savings account.

02

Employers complete simple Payroll Savings deduction each pay cycle.

03

We handle the rest, putting financial wellbeing for employees on autopilot.

Universal Access Payroll Savings is regulated, FSCS-covered, and it paves the way for opt-out or auto-enrolment schemes so that all colleagues can have a savings account by default.

👉 Book a call now to talk about Univesal Access Payroll Savings

What makes

Universal Access different

Universal by default

100% eligibility from day one.

No KYC roadblocks, no admin, no payroll risk.

Frictionless

Regulated & credible

Designed within FCA frameworks with FSCS deposit coverage.

Behaviour-led

Defaults and simple choices drive real participation.

Short-term savings drive resilience. Even a few hundred pounds reduces stress, prevents problem debt, and improves stability at work and at home.

Defaults work: many employers start at £20–£40/month.

Once people start, behaviour compounds — more contributions, more goals, more control.

Small beginnings. Lasting impact.

Why it matters

UNIVERSAL ACCESS PAYROLL SAVINGS

Why now

Financial stress is rising. Employees expect support. Regulators care about resilience, not just pensions. Employers need solutions that actually reach people.

Universal Access makes that possible at scale.

Frequently asked questions

-

The UK’s first Payroll Savings product designed so every employee can save, from day one, without friction.

No forms.

No document uploads.

No KYC dead ends.

Just simple, inclusive saving—built into payroll.

Through our FCA-approved framework, we’ve redesigned how savings accounts can be opened and funded via payroll, while maintaining regulatory standards, consumer protection, and FSCS coverage through our deposit-taking partners.

The result is a saver-first experience that feels:

familiar (like pension saving)

flexible (easy access, goal-based)

and genuinely inclusive

-

Every employee is eligible from day one – regardless of background, previous access to financial products, or confidence navigating financial systems.

We made this possible by working closely within the regulatory framework to ensure this model is compliant, secure, and scalable – partnering with the FCA and FSCS-protected deposit takers from the outset.

-

The proprietary Sync framework (which is approved by the FCA) means every employee is instantly eligible for a Sync Savings account, without any risk or liability to payroll.

We operate the end-to-end infrastructure so your teams don’t have to:

Seamless payroll deductions reporting aligned to any pay cycle

Secure savings account opening and management management with our FSCS protected deposit takers

Apps with full and instant account management functionality as well as goal tracking and progress updates

All regulatory, safeguarding, and reporting obligations handled automatically

Full support for both employers and employees wrapped into a holistic financial wellness product

-

Nope!

No lengthy forms, no document uploads, no KYC dead-ends, just a beautiful, simple and very slick saver centric experience. This is a first-of-its-kind model that treats short-term savings as a mainstream workplace benefit – accessible to all from day one. -

Absolutely: Universal Access paves the way for this approach. You'll simply need to make a small tweak to employment contracts (so that all new joiners are auto-enrolled) and we'll take it from there.