One tap into debt. A dozen hurdles to save. Until now.

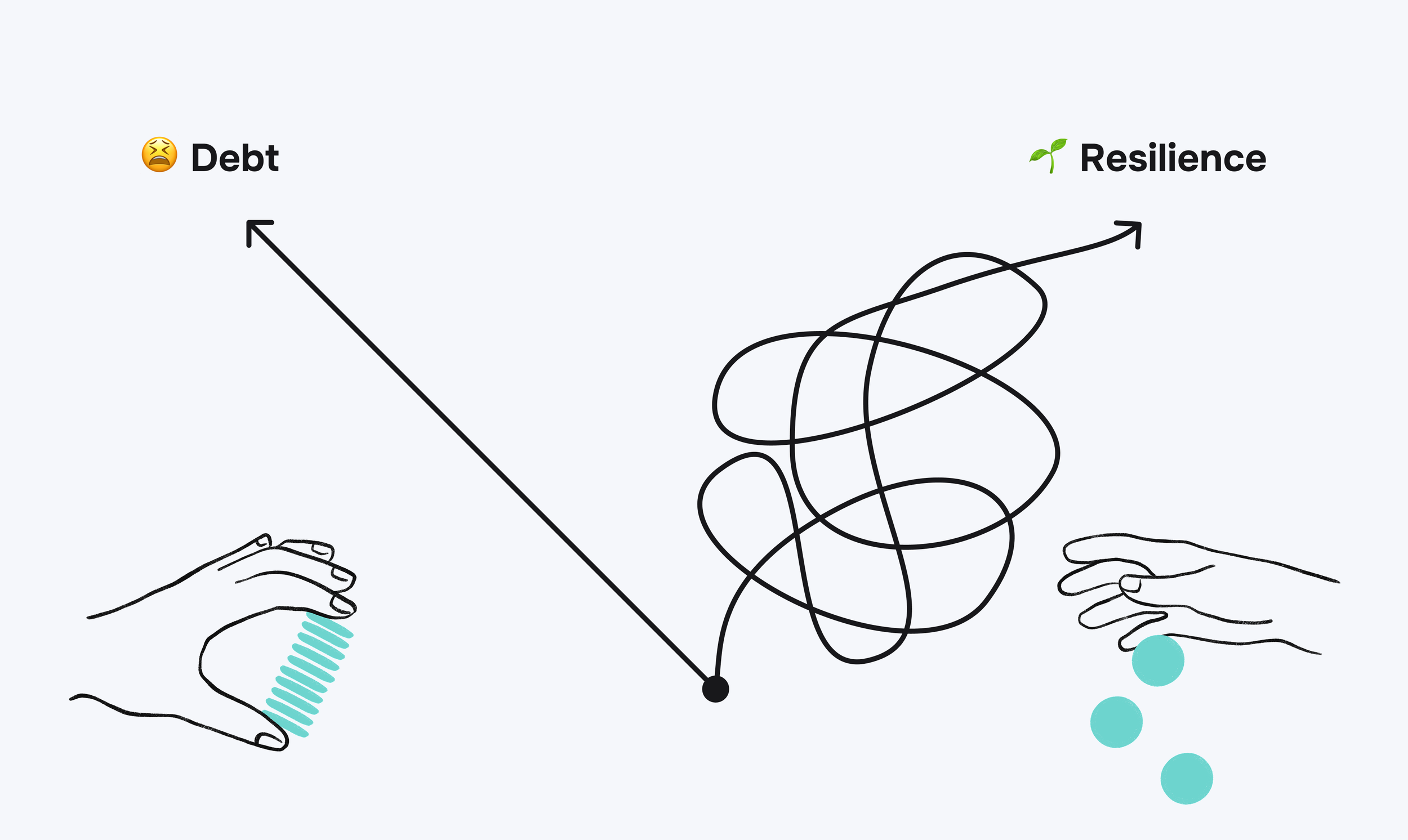

It’s never been easier to get into debt.

A tap for buy now pay later. A click for a credit card. An app for early wage access.

But when it comes to saving, really saving, the experience couldn’t be more different.

In today’s UK, nearly half of adults are financially vulnerable. According to the FCA, 49% of people show signs of financial vulnerability, and around 39% have £1,000 or less in savings. A quarter have no savings at all. That’s not a fringe problem. That’s a national crisis.

And it matters, because without savings, every unexpected cost becomes a shock. A car repair. A boiler breakdown. A missed shift. Without a buffer, people are forced back to the same easy debt that got them stuck in the first place.

Debt is easy. Saving is hard. That’s the problem.

Modern finance has made borrowing frictionless.

Saving? Never straightforward

For many people today:

High street branches have disappeared, making it harder to walk in and open an account.

The best interest rates are hidden behind complex online products and comparison sites.

Opening an account means forms, identity checks, passwords, and decisions people don’t have time or confidence to make.

And even once an account exists, remembering to move money every month is another hurdle, and if even if you do set up a regular payment, life changes and there’s no functionality for instantly amending, or temporarily pausing contributions.

So while debt has been engineered for speed and convenience, saving has been left clunky, manual and easy to put off.

Good intentions don’t survive busy lives and it’s really hurting us.

Why savings matter more than ever

Savings are not just about getting rich.

They are about resilience.

Even a small buffer can:

Reduce stress and anxiety

Stop short term shocks becoming long term problems

Break the cycle of relying on credit

Give people choices when life happens

Provide the gateway to longer term wealth-builiding

Time and again, the evidence is clear. The most reliable way to improve financial wellbeing is simply to have savings. Not more apps. Not more lessons. Just money set aside for the future.

But knowing that doesn’t make it any easier to do.

The real barrier is behaviour, not motivation

The Money and Pensions Services found that almost everyone understands saving and wants to save, most of us just struggle to do it regularly.

That’s because saving competes with everything else money is needed for right now. Rent. Food. Energy. Kids. Life. When saving depends on willpower, it’s the first thing to be dropped.

The only approach that works at scale is the same one pensions have used for decades: make it automatic.

The simple solution - Payroll Savings!

You won’t be surprised that we at Sync as so passionate about our mission and our product, because it works. This is because it’s automated, and skips the current account, over time, small amounts quietly grow into something meaningful - and because all of our pots are goals based you can delight your team by helping them save for what really matters like the long await summer holiday, a cosy Christmas and of course the all important rainy day fund.

That’s how habits are built and how resilience is created.

Auto-enrolment

Payroll delivered pensions at scale and for the first time, it’s doing the same for savings.

Where employers choose to opt everyone in (with lots of communication and opportunities to opt out!) Sync turns payroll into a simple, automated route into high interest savings accounts, helping employees build real financial resilience without changing their day to day lives.

No branches. No paperwork. No willpower required.

Just saving, built into every payslip.

Be part of the solution!

We’ve built a world where getting into debt takes seconds and it’s landed us in a multi-stress criss. Now it’s time to make savings just as easy.

Because when nearly half the country is financially vulnerable, saving isn’t a nice to have, it’s the foundation of financial wellbeing.