Introducing Universal Access Payroll Savings

Why we built it, why it’s unique, and why it changes everything

For years, employers have told us the same thing:

“We want to support our people to save – but the tools just don’t work for everyone.”

Workplace pensions transformed long-term saving by making it automatic, inclusive, and simple. But when it comes to short-term savings – the money people need for emergencies, shocks, and everyday resilience – the system has been stuck in the past.

Until now.

Today, we’re launching Sync’s Universal Access Payroll Savings: the UK’s first Payroll Savings product designed so every employee can save, from day one, without friction.

This is why we built it—and why we believe it’s a game changer.

The problem with workplace savings (as they exist today)

The data is stark:

One in three UK adults has less than £1,000 in accessible savings

Over 14 million people have no emergency buffer at all

Financial stress is now one of the leading drivers of absenteeism, presenteeism, and demand for employer support

And yet, despite growing awareness of financial wellbeing, most workplace savings schemes still fail the people who need them most.

Why?

Because they rely on traditional retail onboarding models:

Lengthy forms

Document uploads

Credit-style checks

Drop-off before anyone even starts saving

The result? Low take-up, unequal access, and a benefit that works best for people who are already financially confident.

Employers told us this wasn’t good enough.

What employers asked for instead

In conversations with HR, reward, payroll, and finance leaders across sectors – from retail and care to manufacturing and financial services – we heard a clear set of requirements:

“We want something that works for everyone, not just the confident few.”

“We can’t add more admin or risk to payroll.”

“It needs to be properly regulated and safe.”

“It should feel as easy and normal as pension saving.”

Crucially, employers didn’t want another app or optional extra.

They wanted infrastructure.

That’s what we set out to build.

What is Universal Access Payroll Savings?

Universal Access is Sync’s breakthrough payroll savings product that makes every employee instantly eligible for a regulated savings account, without traditional onboarding barriers.

No forms.

No document uploads.

No KYC dead ends.

Just simple, inclusive saving—built into payroll.

Through our FCA-approved framework, we’ve redesigned how savings accounts can be opened and funded via payroll, while maintaining regulatory standards, consumer protection, and FSCS coverage through our deposit-taking partners.

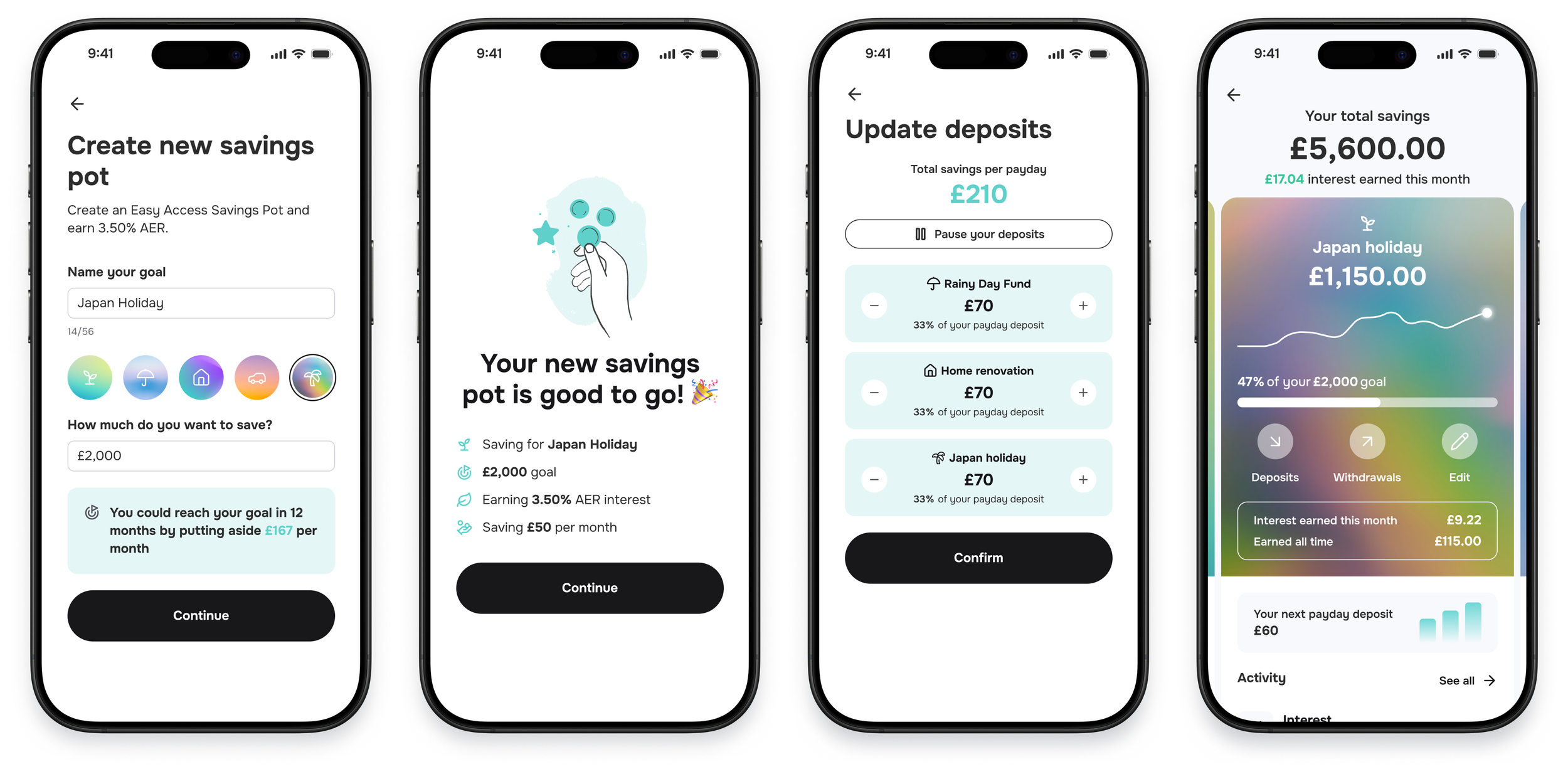

The result is a saver-first experience that feels:

familiar (like pension saving)

flexible (easy access, goal-based)

and genuinely inclusive

Why Universal Access is genuinely different

This isn’t a feature tweak. It’s a structural shift.

1. Universal means universal

Every employee is eligible from day one – regardless of background, previous access to financial products, or confidence navigating financial systems.

2. Built for payroll, not retrofitted to it

Universal Access is designed as payroll infrastructure, not a consumer savings product bolted on after the fact. Employers make one simple payroll instruction; Sync handles everything else.

3. Regulated by design

We worked closely within the regulatory framework to ensure this model is compliant, secure, and scalable—partnering with the FCA and FSCS-protected deposit takers from the outset.

4. Behavioural science at its core

Automatic eligibility, simple choices, and goal-based saving dramatically increase participation. When saving is easy and supported, people actually do it.

Why this is a game changer for financial wellbeing

Short-term savings are one of the strongest predictors of financial resilience.

Research consistently shows that building even a few hundred pounds in accessible savings:

reduces stress and anxiety

lowers the risk of falling into problem debt

improves stability at work and at home

And reaching around £2,000 in savings can reduce the likelihood of future financial difficulty by more than half.

Universal Access makes that possible at scale.

Not just for some employees.

For everyone.

Why regular saving changes everything

The evidence is clear: people who save regularly don’t just have more money – they have better financial lives.

Research consistently shows that even small, habitual saving:

increases feelings of control and confidence

reduces anxiety and financial stress

lowers the likelihood of falling into arrears or problem debt

makes people more resilient to shocks, from car repairs to childcare costs

Crucially, it’s the habit that matters most – not the size of the first contribution.

That insight shaped how we designed Universal Access.

That’s the quiet power of payroll saving done properly: small beginnings, lasting impact.

In practice, many employers choose to introduce payroll saving with a gentle default contribution – often £20 or £40 per month, reflecting learnings from real-world trials such as the widely cited SUEZ payroll savings pilot, which demonstrated that small, automatic deductions dramatically improve take-up without causing financial strain.

What’s powerful is what happens next.

Once people are nudged into saving, even at a modest level, they engage. They log in. They explore. They take control.

Across Sync programmes, we consistently see a high proportion of savers actively interacting with the platform after that first nudge:

setting up additional savings pots for specific goals

increasing their monthly contribution once they feel confident

and using goal-tracking to stay motivated and on course

In other words, the default doesn’t limit people – it unlocks them.

Universal Access doesn’t force anyone to save more than they can afford. It simply makes starting easy. And once people start, their behaviour changes.

Why this matters now

Employers are under pressure—from rising costs, from workforce expectations, and from the reality that financial stress shows up at work every day.

At the same time, policymakers and regulators are recognising that financial resilience isn’t just about pensions. People need support today, not just at retirement.

Universal Access Payroll Savings sits exactly at that intersection:

practical for employers

inclusive for employees

credible for regulators

transformative for outcomes

What comes next

This launch is just the beginning.

Universal Access is the foundation for:

salary-sacrifice emergency savings

smarter incentives for employers

deeper integration with financial wellbeing strategies

and a future where payroll saving is as normal—and as powerful—as pension saving

We built Universal Access because employers asked for something better.

Now, it’s here.